Safestyle UK, one of the largest installers of windows and doors into residential properties, has this week reported strong first half 2016 sales. This comes as the glazing industry tries to get to grips with the Brexit vote fallout and if there has been any immediate effects after the referendum results.

The Bradford-based business has said it expects to post sales of £83.5m in the first six months to June 30th. This would represent a rise of 12.8% for Safestyle UK and follows a string of positive results since becoming listed on the LSE.

Speaking on business website Insider Media, chief executive Steve Birmingham said:

We are very pleased with our performance in the first half of this year,” said chief executive Steve Birmingham.

Whilst the longer term impact of the referendum decision on the broader economy remains to be seen, there has been no short term detrimental effect on our order intake.

During the first half of the year our order book increased significantly and we will benefit from a controlled release of some of this increase in the second half.

The company has a proven successful model, with a growth strategy underpinned by a combination of our expanded product range, attractive promotional finance package, continued geographic expansion and financial strength.

As a result, the board remains confident in our ability to continue to outperform the market and achieve full year results in line with management expectations.

Read the full article

So, cheery good news among the doom and gloom stories from other parts of the mainstream media.

Safestyle shared up and down this year

Whilst these are good results, a quick look at the Safestyle UK share price on Bloomberg shows that the share price has had a pretty volatile year so far:

It’s been quite a year of steep rises and falls. I don’t think this reflects the performance of the company when you look at the half year results. More that the external conditions in which they were being traded were becoming more and more volatile the closer we got to the EU Referendum vote.

You only need to look at the steep drop near the end of June then the sharp jump back up as an example of that.

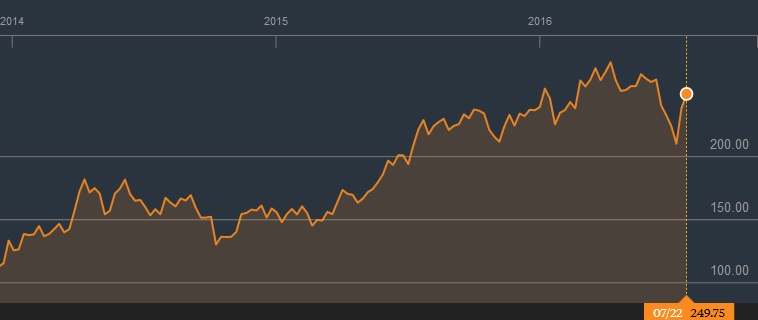

If we take a longer term view and go back to 2014 when they first listed on the stock exchange, it’s been an impressive rise:

That’s one impressive chart showing one impressive march onwards. Perhaps we all should have spent a few quid back when they were first listed.

Reality check

This is clearly very good news for Safestyle, and a decent bell-weather for the rest of the industry. Their business plan is working for them. But it is worth remembering that as a national company, just the same as all the other national installers, they operate a number of businesses practices that regular readers know I most definitely don’t approve of.

So until they and the others decide to drop highly inflated discount structures, protracted and often stressful client negotiation processes, I won’t be able to respect them as a business.

To get weekly updates from DGB sent to your inbox, enter your email address in the space below to subscribe: