I am sure many of us will remember the calamitous moment when Lehman Brothers, the 150 year old bank that was a fundamental corner stone of the US and global financial markets, filed for Chapter 11 bankruptcy.

It was the moment that the world came literally within hours of a total and catastrophic collapse of the global financial system. The effects of that would have been horrendous.

But the world bailed the system out, using taxpayer’s money, and the end of the world was put off for another time. Eight years on, many regulations have changed, stress tests have been introduced and recapitalization of the banks has happened.

Yet, despite one of the biggest crises the world has seen in recent times, we’re looking at a situation at German bank Deutsche Bank which could spark off another Lehman Brothers moment. And that is something we should all be terribly worried about.

Deutsche Bank

The trouble German bank has been identified by many financial institutions as the single biggest risk to the banking system. It has bled money for a long time. Fines by various countries over problems like mis-selling, LIBOR and other scandals have cost the bank many billions in penalties. The latest fine, from the US, is $14bn. A fine of this size would pretty much wipe the bank out as it’s market value is only $14.3bn at the time of writing.

The bank has been trying to offload as many of it’s assets as possible to recover funds and keep liquidity flowing. But there’s only so many assets that can be sold. And the bank has continued to lose money hand over fist quarter after quarter.

Similar share prices

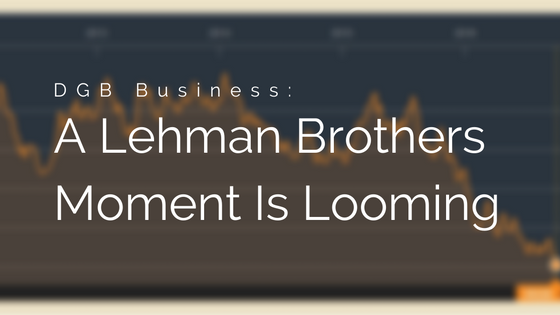

This is the five year performance of Deutsche Bank shares according to Bloomberg:

Credit: Bloomberg

Whichever way you look at that chart, it’s bad. It hit a new low today, dipping under ten euros a share for the first time ever. It has recovered a little, but on the whole, it’s sell sell sell for investors.

A number of hedge funds have also been moving some of their money out of the bank. A sign that nerves are building in a big way and those funds are wanting reduce their exposure should the worst happen.

Here’s the really scary bit. Go to Google and search for the Lehman Brothers share price. Look at those charts and then look back at the one above. They’re eerily similar. In fact that’s not the only similarity between the Lehman Brothers crash and this one.

Similarities

Earlier on in the year, Deutsche Bank CEO John Cryan came out an said that the bank was on a sound footing, liquidity was good and steps were being taken to ensure things will run smoothly. Many of us will remember the moment Lehman Brothers CEO Richard S. Fuld spoke to the world to say very much the same thing. It didn’t quite work out like that.

Then there is the share price performance of Deutsche and Lehman. Go to Google and search for the share prices of the two companies. Those charts will look scarily similar. When Lehamn began to look shaky, investors and hedge funds began to pull money out fast, and sank the share price. The same has started to happen to Deutsche Bank, with a number of funds already moving money away.

Think the German Government will back the bank up? Think again. The German Govt has now stated on a number of occasions, despite numerous reports, that it will not be rescuing the bank, and it will be up to them to solve. If you remember, despite talks and negotiations, the US Government declined to save Lehman Brothers.

How bad could it be?

Right now, it depends on what reports you choose to read. There are some who say it won’t be as bad as Lehman Brothers. There are some who say it could be worse.

It’s worth mentioning that Deutsche Bank’s exposure in lending is five times the size of Lehman. If the bank was suddenly removed from the system, it’s hard to imagine that figures lent in the trillions won’t have a negative effect across the whole banking system.

What we should be looking for are signs of mass withdrawals of funds. If customers of the bank, and hedge funds begin to panic and start withdrawing their funds, it will put immense pressure on an institution that is already teetering.

There is a question to answer here: is the bank insolvent or does it have liquidity problems? If it’s a liquidity issue then it has a decent chance of being resolved. If it’s an insolvency problem, then it’s much worse.

If the bank was to go the same way as Lehman Brothers, Brexit and the LB failure will seems like a very tiny tremor. And if it does, keep an eye on Italy. That will be the next epicentre.

To get weekly updates from DGB sent to your inbox, enter your email address in the space below to subscribe:

It’s what happens when enough people blag it and not enough people stand up and question it .

It is a shame when the realists are shouted down by the ‘establishment’ who are nothing but the blaggers taking the piss in the first place.

Multiply this by a million times to a scale that is impossible to conceive and hey ho , you have the current world banking economy , simple really .

It happens everywhere , even in double glazing :(

I’ll add ….

What really pisses me off is that in our own ‘industry’ there are enough people in influence who know of the serious corruption and fraud that provides a platform for possibly 60% of its income , and that’s from the top.

If it’s wrong it’s wrong , you can’t spin it any other way.