Another Safestyle UK trading update and another disappointing one from the company. During the course of 2017 there was a procession of negative news out of the business, which saw it’s share price tumble to fresh lows each time.

That pattern continued last week as it published it’s latest trading update delivered another blow to investors.

The update

This was the text of the update:

Safestyle UK plc, the leading retailer and manufacturer of PVCu replacement windows and doors to the UK homeowner market, today issues an update on current trading.

The Group announced on 13 December 2017 that it had seen a continuing deterioration in the market resulting from declining consumer confidence and the Board expected market conditions to continue to be very challenging in 2018. The activities of an aggressive new market entrant have added to an already competitive landscape and impacted the Group in certain areas of its operations. As a result, the Group’s order intake in 2018 to date has been disappointing and below our expectations.

The Group has reviewed and reduced its cost base and carried out the planned restructuring of its Sales and Canvass functions. The Group continues to invest in information technology to ensure it can deliver an enhanced end-to-end customer experience and improve operational efficiency.

Guidance for the year ended 31 December 2017 remains unchanged. The Board now expects Group revenues and underlying profit before tax for the year ending 31 December 2018 to be materially below 2017 levels and current market expectations.

The Group continues to be cash generative, with a strong cash position and robust balance sheet. Safestyle remains very well invested for any upturn in demand and the Board expects the benefits of its cost savings programme to take effect in 2018, particularly in the second half.

The Group will announce its final results for the year ended 31 December 2017 on 22 March 2018 when it expects to declare a final dividend for 2017 of 7.5p in line with its normal 1/3:2/3 policy.

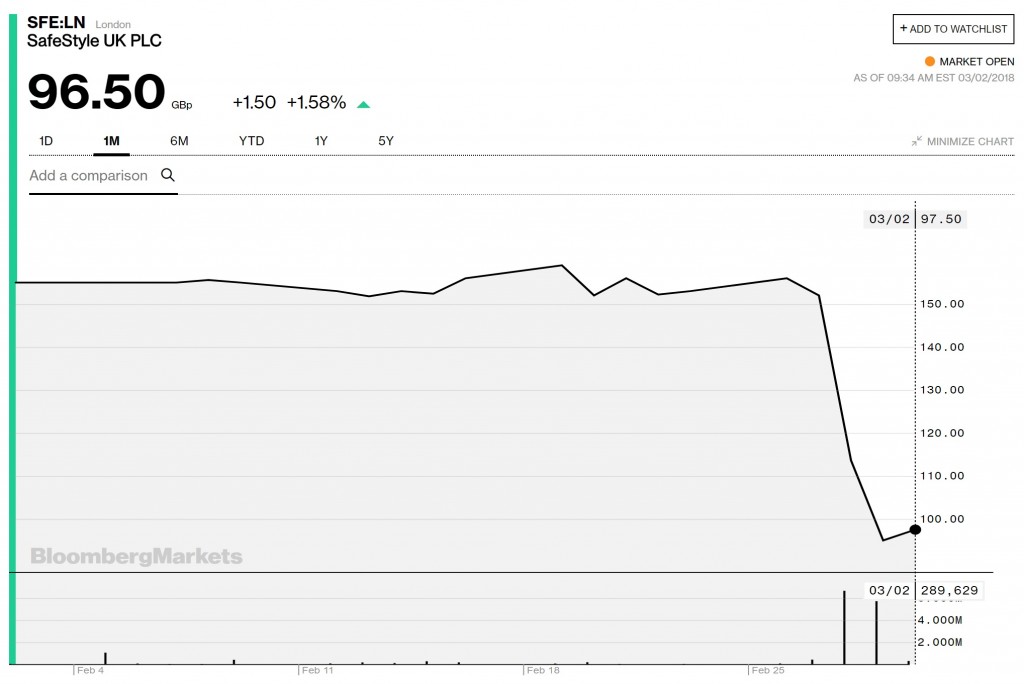

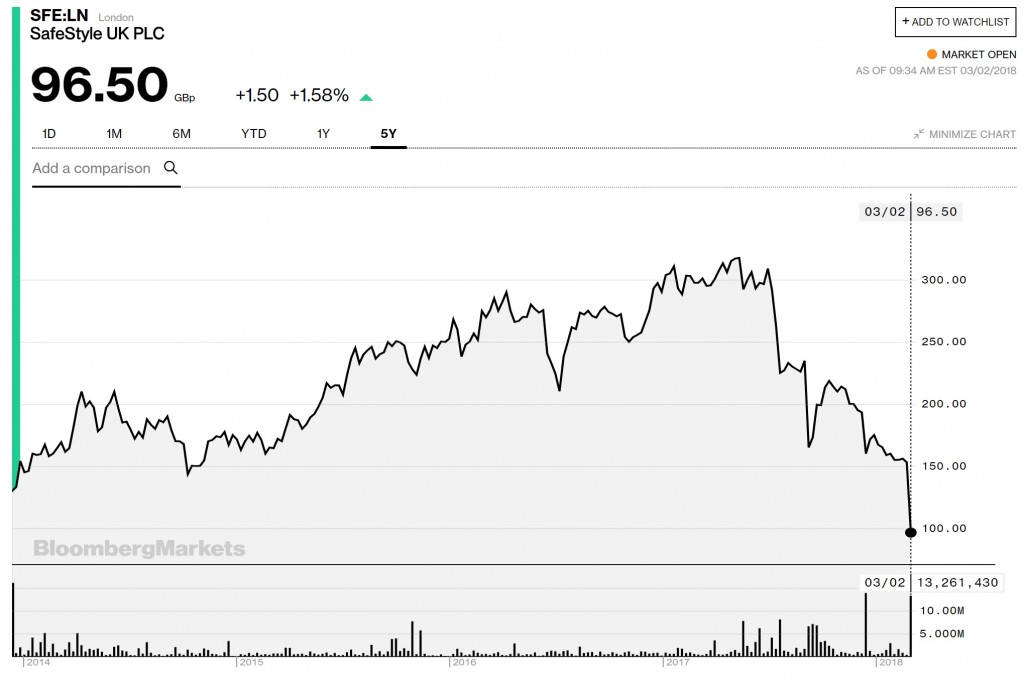

On the news, this is what happened to their share price. Below is a 1 month chart and a 5 year chart side by side:

Company shares are now trading at multi-year lows. It’s also worth pointing out that the “new market entrant” they describe as being aggressive is SafeGlaze UK. Yeah I know, how original. You may have seen their seriously questionable advert on TV recently. A new company, based in Bradford, appear to be going straight in for the market SafeStyle operates in, and reports have said that they have already made serious dents into their business. Like their tactics or not, it has worked to such a degree that SafeStyle have felt the need to include them in their trading update.

Failing business model

Last week we saw Maplin and Toys R Us go into administration. A number of restaurant chains have also announced hundreds of store closures. The high street chains that are closing their doors are doing so because of outdated business models operating in a much changed environment.

The same is happening to the very biggest in the window and door industry. The nationals have continued to operate sales and business models that resemble something decades old. They have failed to move with the times and a more educated home owner who wants a buying experience, not the hard-sell. All three major nationals have recently reported poor figures, and the latest SafeStyle update only further confirms what many have been saying for a long while.

Some have said in the past that such sharp drops in share prices are overreactions and that they will recover. But at the time of writing the SafeStyle share price remains under 100p per share. But how many chances do you give a company before you have to admit that the writing is on the wall?

It’s only March, but I think it is a safe bet that before the year is out we could see one of the biggest either go to the wall or get swallowed up by another one of the big ones with enough cash left in reserve. But even if that does happen, it won’t stop the slide south. The only thing that will is a truly radical and drastic shift in the way the big installers operate. And that has to happen in a matter of months. Damage after years of burying heads in sand is now coming to fruition, and there is now a time limit on how long companies have to change their ways.

It might already be too late for some.

To get weekly updates from DGB sent to your inbox, enter your email address in the space below to subscribe: