Another quarter and another profit warning from national window and door installers Safestyle UK. This time, the statement was pretty grim, and the resulting share price performance matched the tone of the update.

The statement

Here are the important bits from the latest trading update statement:

In its Final Results announcement on 22 March 2018 the Group noted that the beginning of the year had been difficult with a continuing deterioration in the market resulting from declining consumer confidence. This was exacerbated by the activities of an aggressive new market entrant and it was noted that this competitor’s actions were impacting the Group in certain areas of its operations, particularly in relation to its Sales and Canvass divisions. As a result, the Group’s order intake in 2018 to date had been weak and its market share was under pressure.

The Board reports that, since then, the activities of this competitor have intensified and the Group has taken longer to rebuild its order intake to the rate previously anticipated and has also experienced cost increases as management takes the necessary actions to address these challenges.

The Board believes it is necessary to take a cautious approach to the prospect of further short-term disruption to the Group’s operations. Therefore, the Board now expects Group revenues and underlying profit before tax for the year ending 31 December 2018 to be significantly below current market expectations with profits for the year expected to be heavily weighted to the second half.

The Board remains resolutely focused on protecting Safestyle’s leading market position. Early evidence shows that the Group’s Sales and Canvass teams are more effective in those locations where rebuilding has occurred. As an immediate priority, the Board is undertaking a detailed strategic review of its operations and has a number of measures in hand aimed at addressing the competitive situation and improving performance.

The Group announced in its Final Results that it was proposing a final dividend of 7.5p per share, subject to the approval of shareholders at the Annual General Meeting to be held on 17 May 2018. As a result of the revised guidance and in order to provide the Company with the strongest balance sheet from which to protect and strengthen its position, the Board believes the most responsible course of action is to preserve the Group’s cash by cancelling the recommended final dividend of 7.5p per share that was due to be paid on 9 July to ordinary shareholders registered on 15 June 2018.

The Group also announces that Steve Halbert, Non-Executive Chairman, has resigned from the Board with immediate effect. Peter Richardson, an existing Non-Executive Director at Safestyle and a member of the Audit, Remuneration and Nominations Committees, has been appointed Non-Executive Chairman with immediate effect.

Read the full trading update statement here

Writing is on the wall

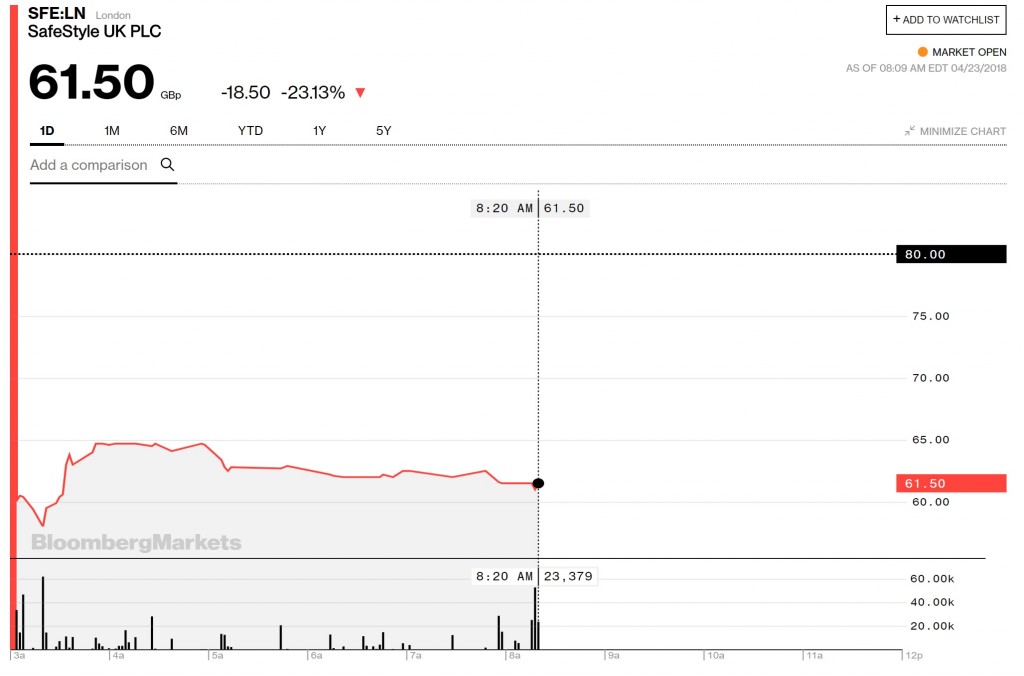

As a result of the statement, this is what happened to shares when markets opened this morning:

Credit: Bloomberg

It’s also worth noting that the volume of Safestyle shares traded today has been very high. It’s not a massively traded stock, but there’s been a lot of movement today and my guess is that most of those have been sell orders.

If you look at some other longer term charts, you can see that the writing has been on the wall for a while now:

1 month chart

Credit: Bloomberg

6 month chart

Credit: Bloomberg

1 year chart

Credit: Bloomberg

5 year chart

Credit: Bloomberg

There’s not a single glimmer of hope in those charts at all. What they demonstrate is a company that has struggled to adapt to a rapidly changing business environment, where outdated business models have been failing. Then, to pour salt into the wound, Safeglaze has exploded on to the scene and have, in their own words “aggressively” eaten away at their market share in just a matter of months.

The ironic thing here is that Safeglaze have been operated like the Safestyle of old, and have managed to make a massive dent in a business that has been trying to move away from their past. Is that a sign that there is still a portion of the public happy to be sold to in the old fashioned hard-sell way? Or is this a unique case of company v company with some very motivated individuals? I’d say the latter myself.

You have to ask yourself at this point how much time is left for the company. Their trading statement prepares investors for a rough time ahead. You know it’s bad when dividends are cancelled. Never a good signal, and a sign that the company needs the cash more than we thought.

To be honest, I’m not sure how much “streamlining” is going to help. For any company to survive they need turnover and profit. We all have managing costs to manage, they’re not on their own there. But the reaction is to increase sales to offset that. You cannot cut your way to profitability all the time. But, if Safeglaze have taken a significant part of their market away, it’s an extremely hard task to start increasing sales when you’re losing well established ground in the market.

I feel like the next couple of months will be a crucial period for the company? Could they become a takeover target? Will they bring in outside help? Will they be able to fight back against Safeglaze? This is a story to keep an eye on.

To get weekly updates from DGB sent to your inbox, enter your email address in the space below to subscribe: