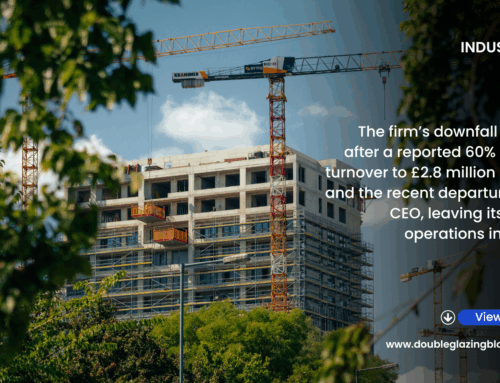

UK construction output plunged at its fastest rate since May 2020 in October, according to the latest S&P Global UK Construction PMI® report, marking the tenth straight month of contraction and the longest downturn since the global financial crisis over 15 years ago. The headline Total Activity Index fell to 44.1 in October, down from 46.2 in September and well below the 50.0 threshold that separates growth from decline. The steep reduction highlights ongoing challenges across the sector, with civil engineering and residential building hit hardest.

Sector Breakdown: Civil Engineering and Housing Lead the Downturn

- Civil Engineering: The weakest performer, with an index of 35.4 – the sharpest drop since May 2020. Firms frequently reported a scarcity of new projects to replace completed work.

- Residential Building: Activity contracted markedly at 43.6, the steepest decline in eight months.

- Commercial Building: Showed relative resilience, with an index of 46.3 little changed from September.

The broader decline stemmed from a sustained fall in new orders, which accelerated in October, though remained milder than the average seen in the first half of 2025. Companies cited sluggish market conditions, fewer tender opportunities, project delays, and heightened political and economic uncertainty deterring client spending.

Jobs Cut at Fastest Pace in Over Five Years

Shrinking workloads and rising payroll costs prompted widespread job reductions. Staffing levels fell at the quickest rate since August 2020, with many firms opting not to replace voluntary leavers. Subcontractor usage also declined, though to the slightest extent, since July. Input buying dropped sharply in line with lower output and orders – the steepest reduction since May 2020 – easing supply chain pressures. Vendor delivery times shortened for the third consecutive month, while subcontractor availability continued to rise.

Cost Pressures Ease, But Optimism Remains Subdued

Input cost inflation slowed to its lowest in 12 months (since October 2024), offering some relief amid the downturn. Looking ahead, business confidence improved slightly to its highest since July, with 34% of firms expecting output growth over the next 12 months compared to 20% forecasting a fall. Hopes for lower borrowing costs, a potential shift in client risk appetite, and stronger demand in areas like energy infrastructure helped lift sentiment. However, overall expectations stayed well below the long-run survey average, reflecting concerns over fragile investment and weak sales pipelines. Tim Moore, Economics Director at S&P Global Market Intelligence, commented:

“UK construction companies reported another challenging month in October as the prolonged weakening of order books so far in 2025 resulted in the fastest decline in business activity for over five years. Civil engineering and residential activity saw the fastest rates of contraction, while commercial building showed some resilience. Reduced workloads were again widely attributed to risk aversion and delayed decision-making among clients.”

The S&P Global UK Construction PMI® is based on responses from around 150 construction firms, collected between 9-30 October 2025. The survey has tracked sector trends since April 1997.

For more details, visit www.spglobal.com/marketintelligence.

Subscribe for FREE below to receive the weekly DGBulletin newsletter and monthly digital magazine!