2016 has been one hell of a year, in many respects. Probably one most would like to forget, for one reason or another. And our industry has not escaped the action either. Aside from the national and global issues that have shocked us to our core, our industry has been going through some quite seismic changes too. Namely, consolidation and a rapidly volatile M&A market.

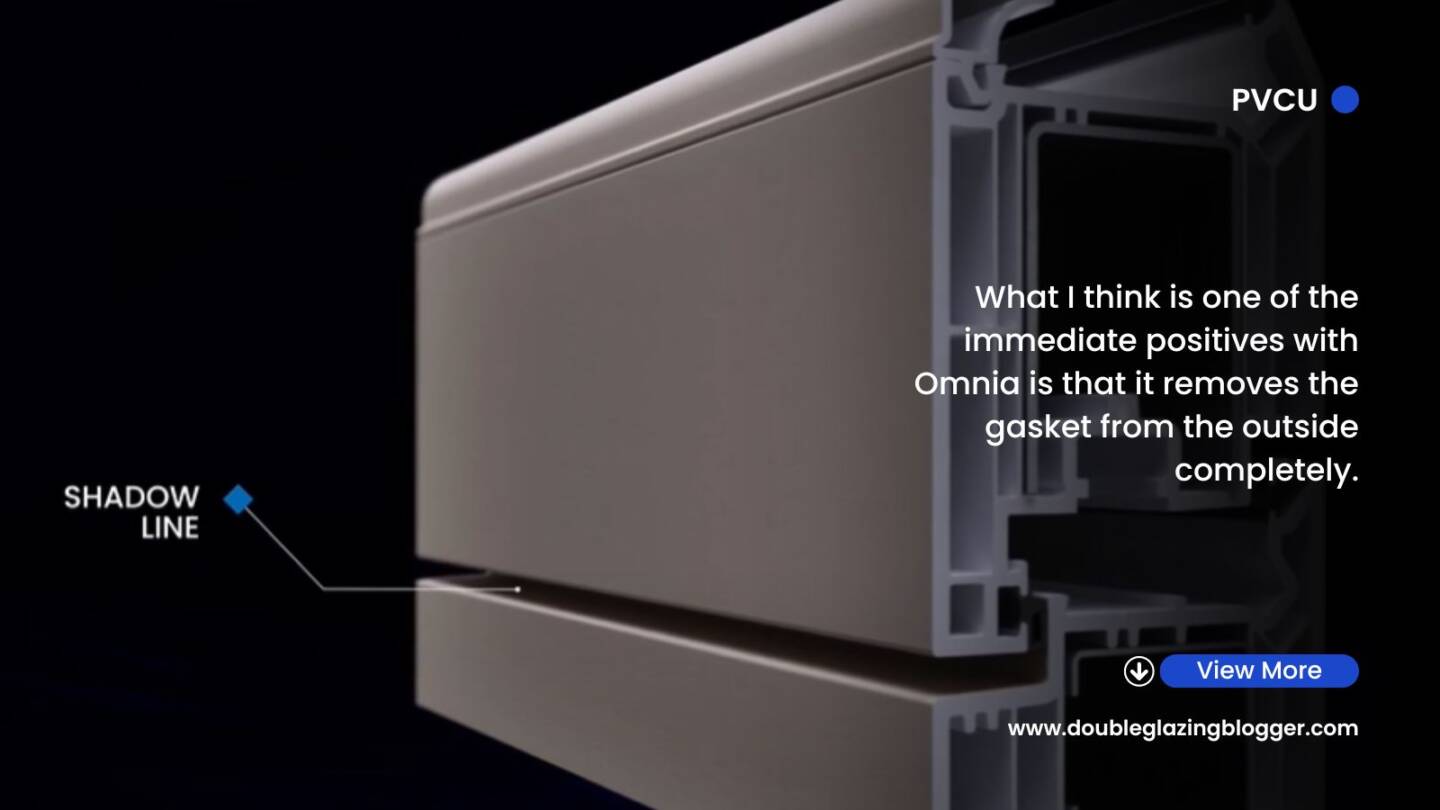

If you were to single out one particular area that has undergone the most change and seen the most action, it has been the PVCu part of our market. Specifically, fabrication. We’ve seen buyouts, mergers, acquisitions and a fair bit of vertical integration. If you somehow missed all of that, you can catch up on it via DGB Features.

And if you were to ask me what part of the market will be most volatile for 2017, I would say it would be the PVCu fabrication market again. In fact, it could be shaken up even more than we have seen this year.

Threats from all directions

The PVCu market is perhaps the one part of our industry that has to adapt the most. It has threats coming from all directions. A resurgent timber market. An aluminium market that shows no signs of stopping. A perceived over-balance of fabricators vs installers vs consumer demand. Raw material price increases. A general public wanting much more than just PVCu options from their installer. It’s not the easiest time to be in PVCu right now.

As other materials continue rise in new popularity, such as timber, aluminium and we cannot leave out the new hybrid systems coming to market now too, the PVCu market faces a growing battle to retain market share with their installers. As home owners ask for more options, installers turn to timber, aluminium and other options. Chances are that sales of PVCu start to drop, and sales of other materials start to increase.

This effect will trickle back up the supply chain and will eventually affect the fabricators. It leads to a situation where there are more fabricators than is needed to facilitate the total business generated. The end result is the number of PVCu fabricators starts to fall as some decide to close, some go to the wall and the more attractive ones are snapped up by groups or bigger fabricators.

The last Insight Data market report showed that for the past seven years the number of PVCu fabricators has been on a steady decline. You can view that post here. However it’s a trend that in 2016 I have seen nothing to indicate that the trend will be reversing any time soon. After an active 2016, next year could be more volatile than this one.

Major consolidation

I can see demand moving from PVCu to aluminium and other materials continuing in the same path next year. I don’t foresee anything profound coming to reverse that. Therefore, consolidation and M&A is set to be a strong theme throughout 2017.

That means there is lots of potential for many more buyouts and mergers. We have already seen groups like Polyframe and Synseal start to flex their cash and exercise their expansion plans in the past six months or so. However I think that could just be the start of a wider and more active trend across the whole industry. There are a number of growing companies and groups that have made it very clear they have an acquisition strategy and will be making good on it in the short to medium turn. I would expect a regular processions of deals, of all kinds of sizes, to be announced in 2017.

Acquisitions could also come from abroad. Thanks to Brexit, the value of Sterling sits around 16% lower than it did pre-vote. Whilst this has increased industry costs, it has also lowered the asking price from British acquisition targets from aabroad. Suddenly, foreign investment in our industry looks a lot more attractive and is a fair size cheaper than it was just a few months ago. Admittedly, foreign buyers may not immediately look at PVCu companies as their primary targets. But if one or two big names crop up as potential targets, then we might see a couple of big deals being done in 2017. That’s if you believe some of the whispers being bandied about at the moment.

Either way, there is still some major consolidation to be done, and a lot of it will be done in the PVCu part of the market. It’s shape, size and structure needs to change fundamentally to reflect a business model that has had to change to suit the demands of a much more informed home owner who wants diversity in the products they can choose from. Not just from one material type.

2017 could be a very interesting year in plastic.

To get weekly updates from DGB sent to your inbox, enter your email address in the space below to subscribe: