Embattled Safestyle UK issued another trading update this morning. The news was not good.

The trading update

Here is the statement in full from the company:

Safestyle UK plc, the leading retailer and manufacturer of PVCu replacement windows and doors to the UK homeowner market, today issues an update on trading.

Since the appointment of Mike Gallacher as CEO on 1 May 2018, the Board and Executive Team have progressed three key priorities – the stabilisation of Safestyle’s organisation, the previously announced legal action against NIAMIC Developments Ltd (trading as SafeGlaze UK) and a comprehensive review of the Group’s current trading and outlook.

Against a background of weaker consumer spending on higher value home improvement products, exacerbated by the loss of significant numbers of canvass, sales and installation staff to the new competitor, order intake has firmed up in recent weeks, albeit at a lower level than the previous management team had expected. Whilst pricing has been firm, with recent price increases being successfully implemented, gross margins in the current year have been impacted through higher digital marketing costs and sales commissions.

At an operational level, the organisation has now been stabilised and the rebuilding of the sales, survey and installation teams is well progressed, both in terms of numbers and capability, albeit the importance of maintaining the quality of recruitment to ensure high customer service levels means this process is likely to extend into 2019. In the short term this has resulted in additional recruitment and some temporary staffing costs.

The Board has assessed the market and operational outlook for the remainder of the year and, providing there is no further material deterioration in market conditions, expects Group revenues to be below market expectations and for the Group to report a small underlying loss before tax for the full year, reflecting the impact of reduced gross margin and increased operating costs. The Company expects to report non-recurring exceptional cash costs of c.£6m in the current financial year. These include, amongst other items, the previously-announced fine following the Health & Safety Executive investigation, the costs of the legal action against NIAMAC Developments Ltd and restructuring costs.

Over the medium and longer term, the Board remains confident of the Group’s prospects. The Board expects exit momentum from the current year to benefit from the programme of costs and margin improvement actions now in train which are expected to result in material annualised savings benefiting future financial years.

As a result of the loss of profits and exceptional costs in the current financial year, offset by working capital management, the Company expects to report a break-even cash balance at the year-end. The business has put in place suitable borrowing facilities to ensure that it has access to appropriate funding, should it be needed, to cover these changed circumstances and any other contingency.

The Company will announce its interim results for the six months ended 30 June 2018 on 20 September 2018.

The Group will also provide an update on its legal action against NIAMIC Developments Ltd in due course.

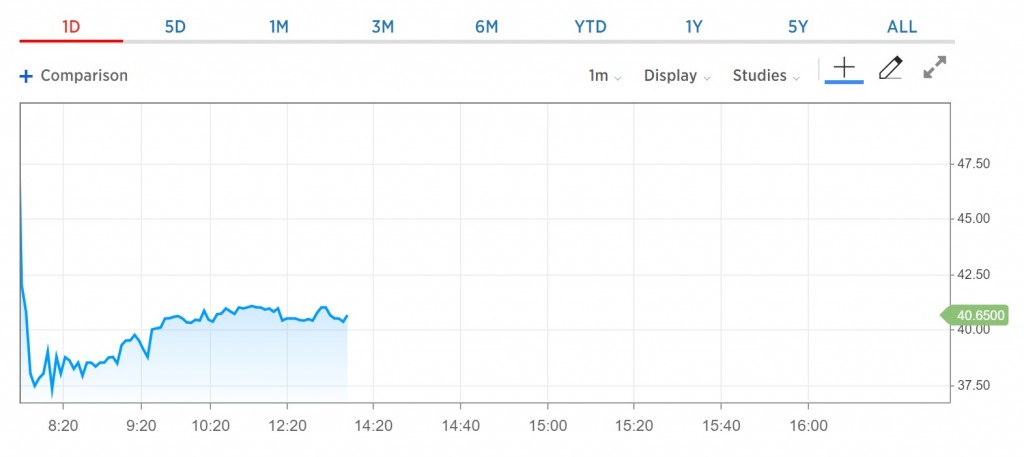

Share price dives

As you would expect, Safestyle’s share price took a nose dive on the news:

The share price this morning dropped to an intra-day low of 36.8p. Remember, these were shares once worth well over 300p each. They now stand at nearly one tenth of that value. Shareholders have been withdrawing their cash in a rapid and orderly manner for the past year or so now.

Perhaps one of the more concerning points in the statement was the “exceptional cash costs” of £6m. This has been blamed on their ongoing legal actions, their recent fine after a worker fall and restructuring costs. In their last statement they did say that they had a relatively healthy cash pile. How much of this remains will now be in question. £6m is a lot to spend for any business, but you have to imagine that most of this will have come from those cash reserves.

Overall, they have tried to paint a positive picture, but the fact remains that the company is still in very dicey territory. They are still reeling from losing a lot of their reps, canvassers, surveyors and installers. They say that they have built those teams up partially, but not back to full strength. Could they even afford to bring it back to full strength?

They continue to blame price increases and a challenging consumer market. But their market is the cheaper end, where profit margins have been squeezed so much there is barely any profit there. As many others have done, they needed to switch to a different business model and product offering years ago. The SME installers out there knew how the market was changing, the biggest refused to evolve in the same way.

As for their competitors in SafeGlaze, I have been told that things aren’t running smoothly there right now. Whether they continue to be Safestyle’s biggest threat is now in question. I would keep an eye on Love Windows. They were incorporated in April and have already had two adverts which have had people talking. I wrote about them in a post you can catch up on here.

The next big announcement will be from their legal action against SafeGlaze. It will be worth watching the share price as the outcome may well send the price one way or another.

To get weekly updates from DGB sent to your inbox, enter your email address in the space below to subscribe:

By subscribing you agree to DGB sending you weekly email updates with all published content on this website, as well as any major updates to the services being run on DGB. Your data is never passed on to third parties or used by external advertising companies. Your data is protected and stored on secure servers run by Fivenines UK Ltd.