The war in Ukraine grinds on, and with each day the humanitarian crisis grows. Millions of people are being displaced within the country and are fleeing to their neighbours in Eastern Europe.

But as the war in Ukraine continues, the fallout of the conflict is now very much working its way into various markets around the world and is causing chaos in energy and commodity markets. If you think this doesn’t affect you or this industry, you’re wrong.

Metal markets madness

You’re going to hear a lot about Nickel today. Nickel, of which Russia produces 7% of the world’s output, goes into the production of things like stainless steel, alloys, surface coatings on hardware in our industry, batteries, medical equipment, power production, transport and more. The price of Nickel soared beyond $100,000 per ton on the LME this morning. This caused trading in the commodity to be halted and has sparked significant concern about some Chinese banks that are heavily exposed in the construction sector and had short-selling positions on Nickel.

These wild moves higher will affect the hardware sector in fenestration. Although it’s not a majority material that is used, any price increases, which will be sharp, will work their way through our market, with end-users feeling the pinch. But it’s not just Nickel, the cost of Aluminium at the time of writing is $3528 per ton. This is actually down 8% from highs of $3850, but is still near record highs. It will take some weeks and months, but raw material costs at these levels will cause further inflationary increases with aluminium systems companies, hardware companies and other parts of the fenestration market exposed to the cost of aluminium.

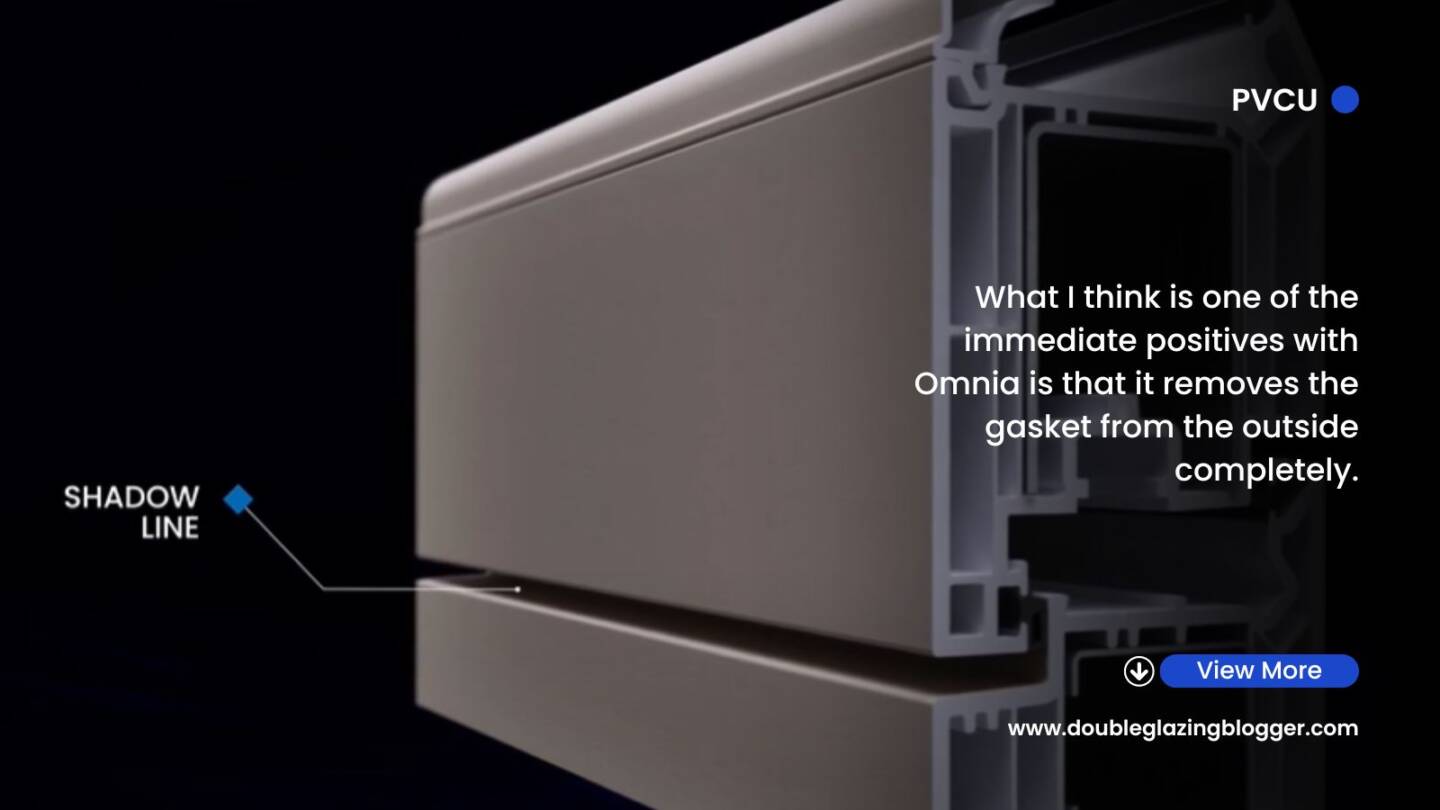

Steel rebar prices are once again rising rapidly, at record highs. Prices according to investing.com show $837.5 per ton. This will ripple through to our sector in a significant way as many PVCu systems use steel reinforcing in their products.

Away from metals, PVC resin has continued to rise. There had been some stabilisation of resin prices towards the end of last year, but that march upwards has resumed.

Oil and gas prices

As many of you will already be aware, the price of oil and gas is going through the roof. Pressure on gas prices was increased further when Russia overnight threatened to turn off gas supplies to Europe if they go ahead with plans to sanction Russian oil and gas. That sent prices even higher.

Oil is also grinding higher. At the start of trading in early Monday morning, Brent Crude touched $140 per barrel. It has since dropped back to $126, which is still historically very high. Higher oil prices have been causing record fuel costs at the pump in the UK. Whilst it is costing a lot more to fill up your car, transport costs for suppliers, manufacturers and haulage firms have also been rising rapidly. UK fenestration will feel this, and I have already been told of price increases being implemented due to higher transport costs.

Then there is gas. You may remember an article not so long ago where it was reported that the monthly energy bills at Pilkington had risen from £1m per month to a staggering £8m per month. A large factor in those bills will be the cost of gas. Gas costs since then have continued to rise so those figures in that report may already be out of date.

Not the same scale, but we have just had our new gas prices at our place and they have more than doubled. Remember that businesses are not protected by the energy price cap in the same way households are. Businesses have felt every penny of every increase. This is feeding into higher prices for pretty much everything, including new windows and doors.

The outlook for oil and gas doesn’t look good. Some predictions on oil show a barrel costing up to $200 by the end of the year. The way the market is behaving, and should the world move completely away from Russian oil, we could be at $200 long before the end of the year.

How to manage the situation

First, it’s important that we as an industry recognise the gravity of the situation. We often have a habit of sticking our heads in the sand, hoping things will sort itself out and that with a bit of positive thinking all will be well. Sadly, this won’t be over in a few days or weeks. Unless there is a sudden and meaningful ceasefire and return to the respecting of the sovereignty of Ukraine by Russia, this will grind on. So will the economic effects. As many world leaders have warned, international norms have now been shattered.

So, our industry has to accept that we will be operating with much higher energy and commodity prices for a sustained period of time. Likely months, maybe years. We also have to acknowledge that our own economic circumstances in the UK are going to be starkly different to 2020 and 2021. We already had a cost of living crisis that is now going to be exacerbated. Some analysts are now talking about inflation running at 10-12%, with some predicting recessions in the UK, US and other major economies.

For the fenestration sector, once we accept these new realities, we can begin to make new plans on how to navigate this very challenging period. It does mean price increases will have to be passed on in the same way they have during the supply chain problems. Sadly, this will contribute further to inflation to the consumer, but our businesses cannot afford to absorb all the increases that come. Spending levels will not be as they have been over the last couple of years. We’re already seeing evidence that there is a significant slowdown in some areas of the market. Not all, but there is a definite shift. Plans that were set in 2021 may not be already out of date.

Efficiencies have to be found within our sector in order to save costs where we can. Companies up and down the supply chain need to look at their own operations and figure out ways to cut down on costs. This could be investing in renewable energy sources, working more from home to cut down on fuel costs, looking at software and tech options to make internal operations faster, expanding product portfolios to attract new revenue streams etc.

Next is marketing. The natural reaction when times are tough is to cut back on things like marketing. This is the equivalent of pouring fuel on a fire. Why become less visible at a time when you need the become more visible? I would hope that our sector has learned lessons from crises past and becomes more aggressive on the marketing front to keep up lead generation and the sales funnels flowing.

Open and reliable communication is also very important. We’re likely to see supply chain disruptions again this year due to various factors. It’s important that we all keep open and constant communication channels between all parts of the supply chain so that if there are problems, we can manage them efficiently and effectively. Remember that more damage is done when communication is poor.

We’re about to enter yet another very rocky period. It’s important to remain calm, think clearly and plan for various scenarios. And remember, whilst we may find it tough here for a while economically, the sacrifices being made in Ukraine to defend itself from an invading force put that all into a very important perspective.

To get weekly updates from DGB sent to your inbox, enter your email address in the space below to subscribe:

By subscribing you agree to DGB sending you weekly email updates with all published content on this website, as well as any major updates to the services being run on DGB. Your data is never passed on to third parties or used by external advertising companies. Your data is protected and stored on secure servers run by Fivenines UK Ltd.